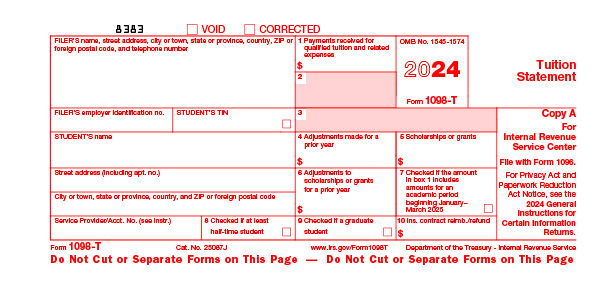

1098-T Tax Form

A 1098-T form is a tax document that is provided by Adelphi University to students who have paid for qualified educational expenses during the tax year.

The form is used to report the amount of tuition and related expenses that may be eligible for certain tax benefits. It is important to keep this form for your records and to provide it to your tax preparer when filing taxes.

Your Adelphi University 2025 1098-T tuition statement will be available online to conveniently view and print as of January 31, 2026.

Accessing Your 1098-T Tax Form

If you haven’t opted to receive your 1098-T electronically, a paper copy will be mailed to you. If you have any questions about your form 1098-T or have not received the form and should have, please call 516.877.3053 or email to 1098tquestions@adelphi.edu.

How to View and Print Your 1098-T

- Log into eCampus and choose the 1098-T Tax Form service under “Find Services”

- View your 1098-T statement and supplemental statement by selecting on the respective links

- Next, select the tax information link

- Choose the year for the form you need to access

Sample 1098T Tax Form

Non-Credit Courses

The IRS requires the University to issue form 1098-T to students who were enrolled during the calendar year in credit-bearing courses leading to a postsecondary degree. Students enrolled in only non-credit courses during the calendar year will not receive IRS form 1098-T.

Frequently Asked Questions

Share a copy with your tax preparer, along with keeping a copy for your records. Since Adelphi sends your form 1098-T information to the IRS, there is no need to attach a copy of the form to your tax return. The information contained in the form 1098-T will help you determine if you may claim the American Opportunity or the Lifetime Learning education tax credits.

In order to provide Adelphi University with your SSN/ITIN, please complete the Request for Student’s Taxpayer Identification Number (PDF) form:

- Complete Parts I and II and report your name and social security number on the form exactly as it appears on your social security card, or as it is reported to the IRS

OR - Complete Part III

Failure to complete the Request for Student’s Taxpayer Identification Number form and provide an accurate SSN/ITIN may result in a $50 penalty from the IRS. If you are in the process of applying for SSN/ITIN, please provide us with this number as soon as you receive it by completing the above form.

How to Submit

You may submit the completed and signed form in person or mail it to:

Adelphi University

One-Stop Student Services Center

1 South Avenue

Levermore Hall, Lower Level, Room 008

Garden City, NY 11530

Please do not email the form, as it contains personally identifiable information.

You can access the payment detail of your account using eCampus, as mentioned above, or you can reference your own banking records for the most complete information regarding payments you made.

Box 4 shows the adjustments made for a prior year, which is an amount of payments that were reported on a 1098-T for a prior year were subsequently adjusted or reduced in the current tax year.

Box 5 shows the scholarships and grants, which means it shows the net amount of certain forms of educational assistance that was received or applied to your student account during the tax year (January through December).

Box 6 shows adjustments to scholarships or grants for a prior year, which means it shows an amount if scholarships or grants that were reported on a 1098-T for a prior year were subsequently adjusted or reduced in the current tax year.

Included on your current form 1098-T may be January/Spring term payments if they were recorded on your account prior to December 31.

Box 8 means to check if at least a half-time student, which means that if checked, indicates that you were considered to be enrolled at least part-time for one or more terms during the tax year (January through December).

Box 9 means to check if you are a graduate student, which means that if checked, you were enrolled in a graduate program for one or more terms during the tax year. Adelphi checks this box if you attended as a graduate student for any term of your enrollment during the tax year.

Scholarships that pay for qualified tuition and related expenses are not taxable to the student. However, if any portion of your scholarships paid for non-qualified expenses, then you may be responsible for reporting such a portion as taxable income on your tax return. You should consult your tax advisor.

For further guidance, please review IRS Publication 970, ‘Tax Benefits for Education’ at the IRS website.

Fees charged for late registration and/or late payments are non-qualified expenses, and are not reported anywhere on form.

Yes, as long as a form was issued to you.

Follow the instructions above for getting a copy of your form 1098-T online via eCampus, making sure to select the tax year of interest from the drop-down menu box.

Please note, the current tax year appears in the window by default.

If you graduated in May, it is possible your spring terms charges were billed in the prior year.

You can view details of the amounts on your form via eCampus.