Guide to Your College Financing Plan

Your College Financing Plan (CFP) provides an estimated overview of the cost of attendance and your financial aid for one year at Adelphi University.

Please use the guide below to help you understand the breakdown of your potential expenses and the financial aid you will receive.

What is a College Financing Plan?

An example of a College Financing Plan document. This is not a bill, but rather an estimate to help you understand what you may have to pay to Adelphi. It provides a clear, concise breakdown of a your financial aid package.

If your housing status or the amount of credits you’re taking changes, this may affect your financial aid.

Please get in touch with the One-Stop Student Services Center with any changes.

Reading and Understanding Your College Financing Plan

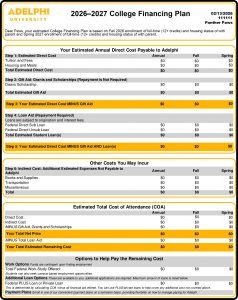

Your Estimated Direct Cost Payable to Adelphi University

Step 1: Estimated Direct Cost

These are your direct cost to Adelphi University. This includes tuition and fees and housing if you are living on campus.

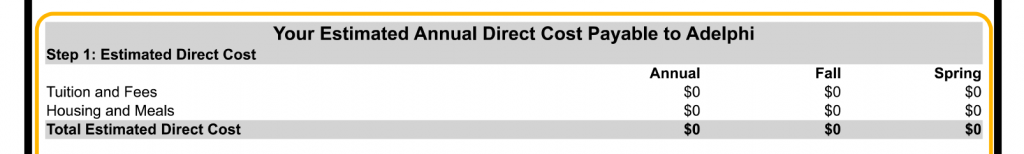

Step 2: Gift Aid: Grants and Scholarships

Scholarships and grants are types of aid that do not have to be repaid. They may take the form of Adelphi University scholarships or need-based grants, federal or state grants, or outside scholarships. Application deadlines may apply to certain types of aid.

Step 3: Estimated Gift Aid

This is your estimate of what you will owe Adelphi minus gift aid you received.

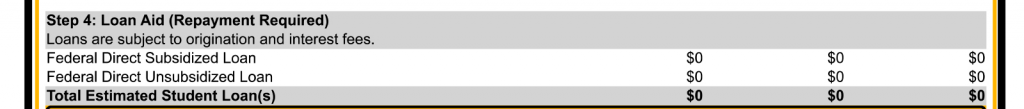

Step 4: Load Aid Repayment

These are the Federal Direct Loans that have been awarded to you. If you wish to borrow, you must complete an electronic Master Promissory Note (MPN), along with the Entrance Counseling session at studentaid.gov to make sure your loan funds are credited to your account.

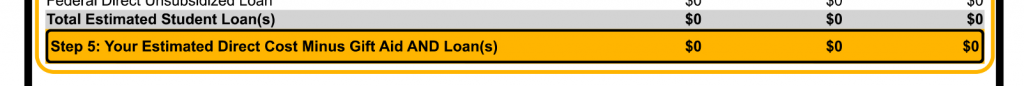

Step 5: Estimated Direct Cost Minus Gift Aid

This is your estimate of what you will owe minus gift aid and loans if you borrow.

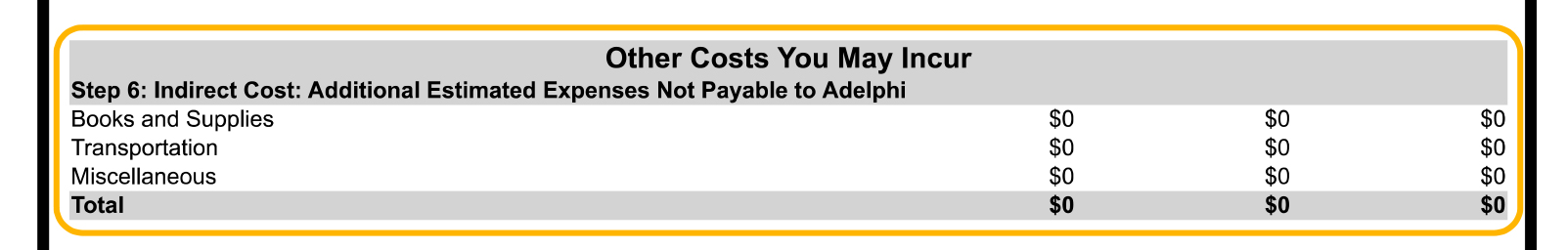

Other Costs You May Incur

Step 6: Indirect Costs

These are estimates of additional costs that may come up during your time as a student, such as books, supplies, transportation and personal expenses. These are not paid to Adelphi.

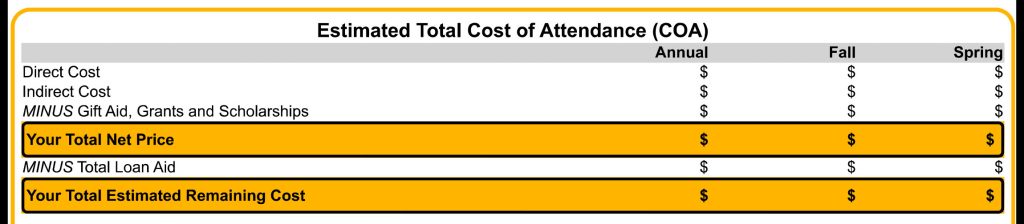

Estimated Cost of Attendance

The Estimated Cost of Attendance (COA) includes both direct and indirect costs.

After applying any gift aid, the remaining amount is your Total Net Price. If you choose to borrow, loan aid can help cover this cost, and the difference between your Total Net Price and loan aid determines your Estimated Remaining Cost. This final amount represents what you may need to pay out-of-pocket.

How to Calculate Your Total Net Price

How to Calculate Your Total Estimated Remaining Cost

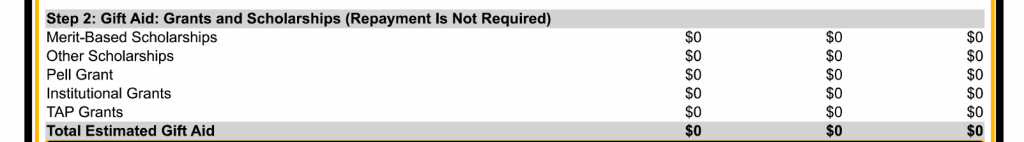

Options to Help Pay the Remaining Cost

- Federal Work Study is an opportunity to work on campus. Earnings will go directly to you.

- PLUS and private loans are additional options to help pay for educational expenses not covered by financial aid.

- Payment Plans provide flexibility on how to manage paying for Adelphi.